FINANCIAL MANAGEMENT TIPS

Making up for Losses

In business, sadly you can lose an item through obsolescence or pilferage. Or you can supply a product or service without it being billed or paid. If that happens, how many more do you

need to sell to cover your loss?

Well that depends on Gross Profit Margin, but it's a simple calculation. You need to sell as many at that profit margin as is needed to cover the cost of the item lost, i.e.

| Sales price | 200 | 100% | |

| Cost | 150 | 75% | |

| Gross Profit Margin |

50 | 25% | 75% / 25% = 3 i.e. 3 x 50 profit covers 150 cost lost |

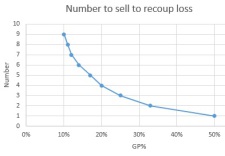

As your margin reduces, the number you need to sell rises sharply, and the more painful each loss becomes:

| Margin | Need to sell |

| 50% | 1 |

| 33% | 2 |

| 25% | 3 |

| 20% | 4 |

| 17% | 5 |

| 14% | 6 |

| 12% | 7 |

| 11% | 8 |

| 10% | 9 |

However, this is simplistic. Don't forget there are additional costs such as sales commissions, administration costs and possibly loss of business through letting your customer down. So you need to sell even more to cover your cost.

So it is important to:

- Reduce the risk of an item being lost or unpaid to a minimum

- In your competitive context, set a Gross Profit % at a high enough level to cover that minimum

Camwells can help by:

- Reviewing and improving systems and processes to include the controls necessary to minimise risk of loss. This can be with existing systems, or for the implementation of new systems.

- Help you set an appropriate Gross Profit % target in you pricing, in the context of the business finances and competitive pressures.

Camwells celebrates three decades at the forefront of business

So you’ve got a great business idea? Validate, challenge and strengthen it with the Camwells 360° Business Review Free initial discussion:

'Camwell Consulting'

was founded in 1993.